We provide you with expert information about insurances (material insurances and health insurances), investments, pensions, real estate, real estate financing, bank account and consumer credit, tax savings and tax subsidy recommendations.

Health Insurance

Huge demographic transformations are affecting the healthcare system in Germany. Relying only on the public health system will most likely bring serious complications and insufficient services both for Germans and expats alike.

Why, what and how - general information

Why is this relevant to you?

Expats face unique challenges in their quest for prosperous medical coverage:

- The right choice of health care system for one’s specific profession is crucial.

- Booking an appointment with a doctor on short notice, having access to the best specialists who speak foreign languages, the freedom to choose specialized treatments – are no longer offered by the public system.

- High income professionals already pay the maximum contribution for the same kind of medical service offered to lower income earners for the public insurance.

Germany has a highly complex social security system that offers lots of benefits. In this respect, the system is very unique with its five sectors. Nevertheless, there are particular aspects of the social security system that should be reconsidered. People arriving in Germany for the first time with a different language and culture, along with various tasks and expectations, might be overloaded with new impressions and information. For instance, did you know that in Germany there are two types of health insurances? Wouldn’t it be ideal to have competent partner to provide and guide you through the facts of the two systems (public and private) and offer the right recommendations to begin with?

We are more than happy to assist you in any questions you might have about your health insurance!

How do we provide financial advisory services?

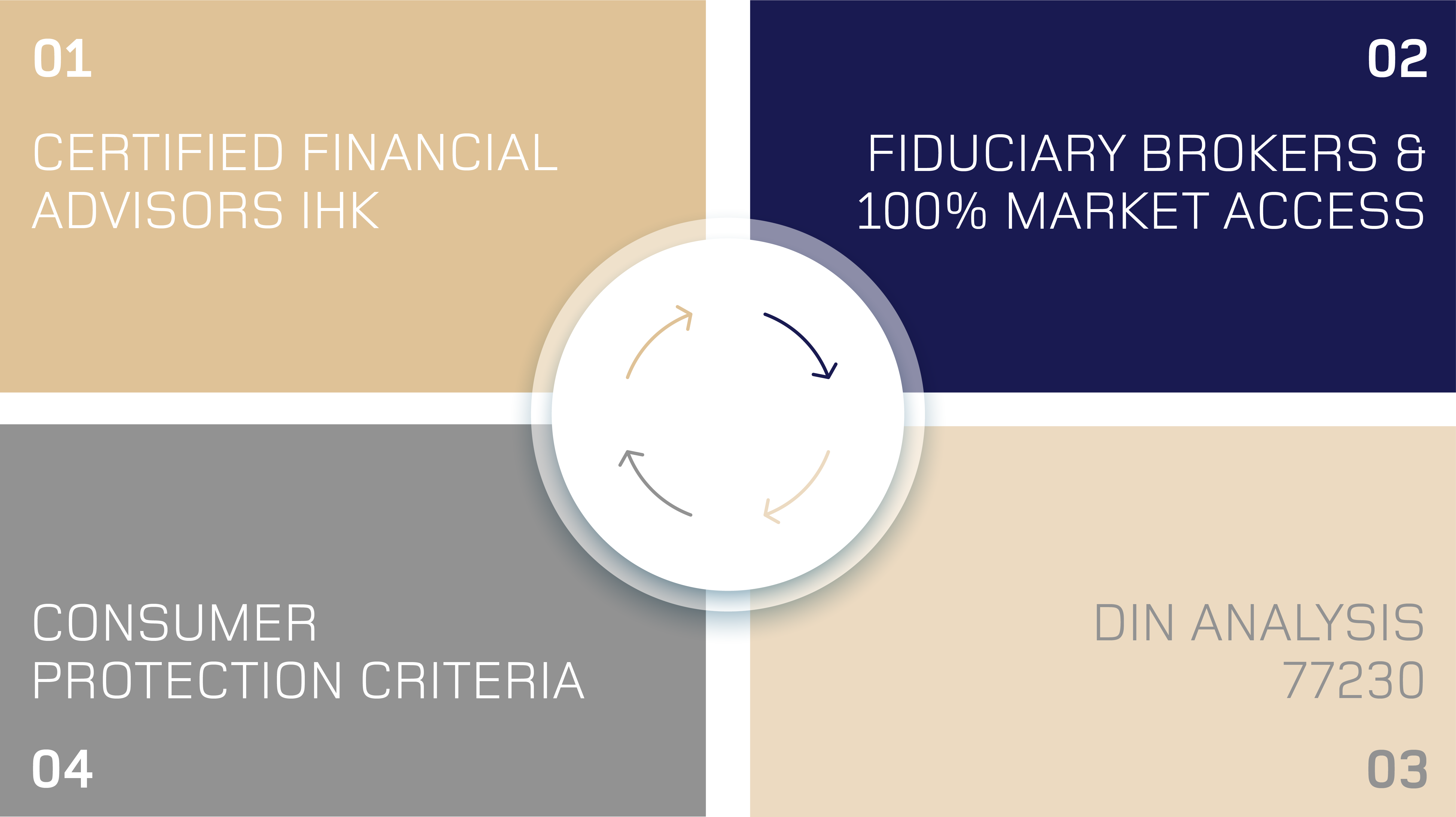

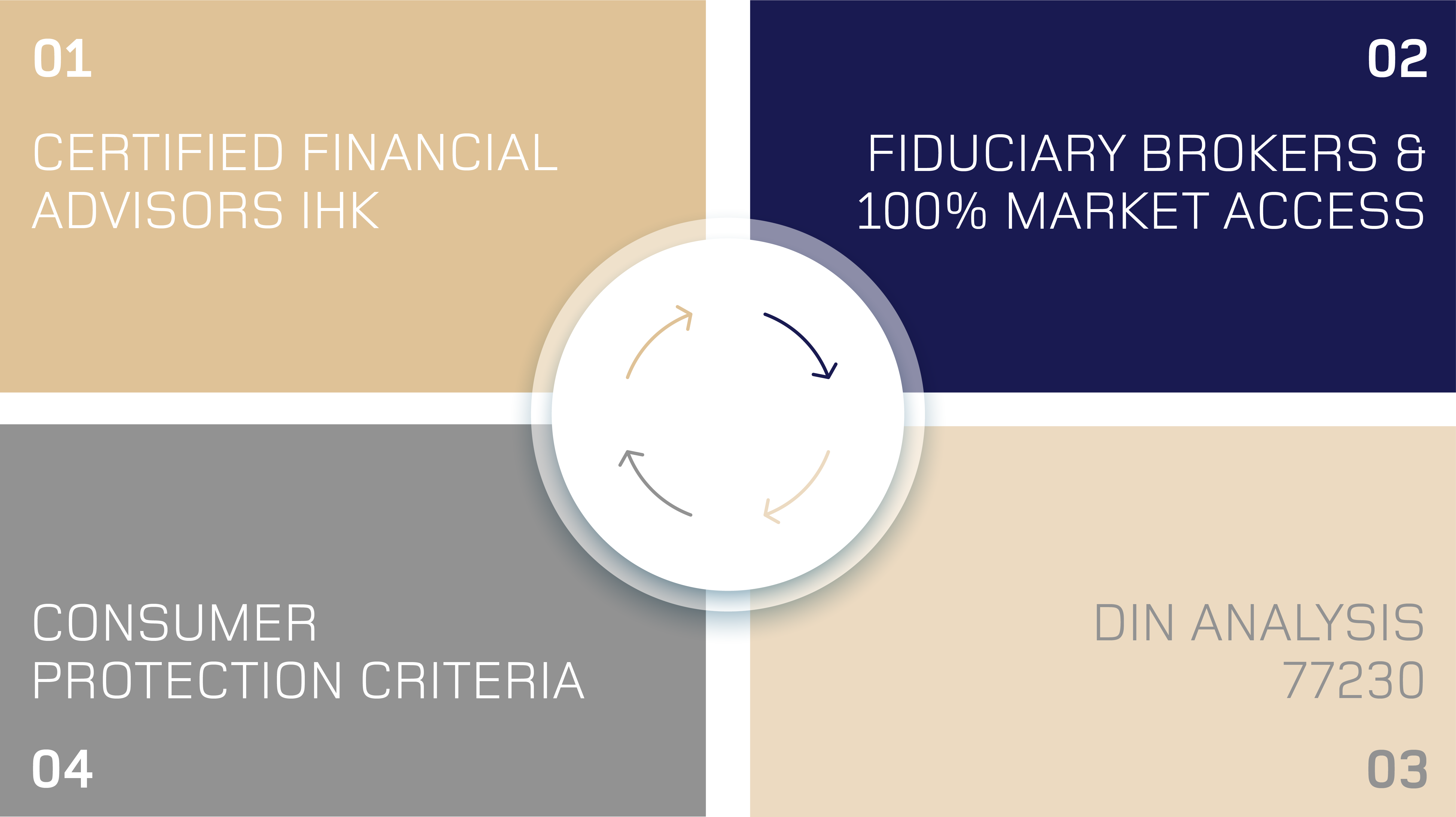

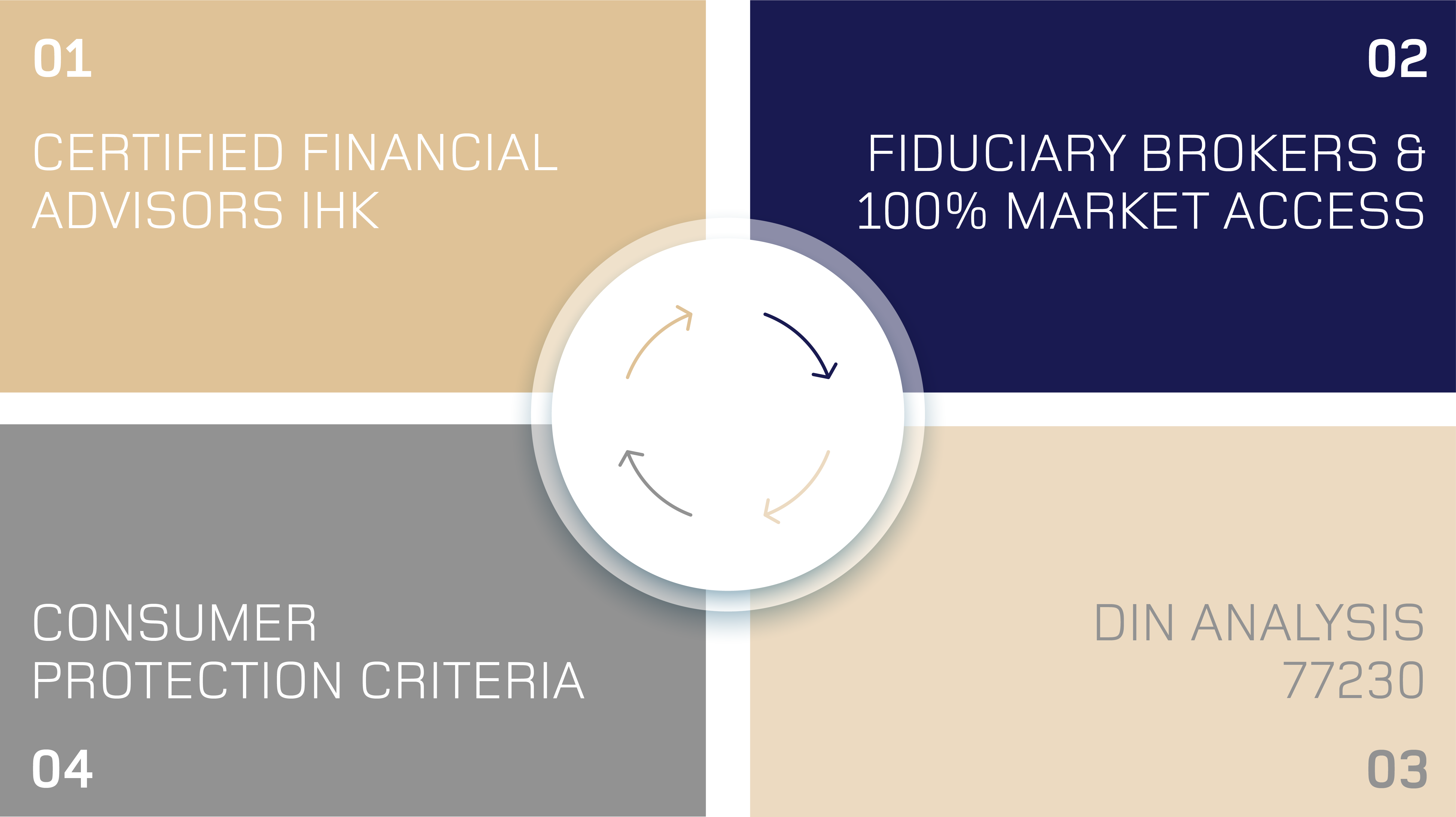

There are 5 key value propositions to working with us:

- Free of charge appointment, resources, and strategic support.

- As fiduciary brokers, we are obliged to screen the whole market in search of the best solutions, based on our client’s best interests. not the financial product providers.

- Our recommendations rely upon the unique DIN 77230, the official DIN Norm, basic financial analysis for private households. Neutral, measurable, scientific and objective.

- Consumer Protection. The product selection fulfills the rigorous criteria of 3 Consumer Protection Institutions: Finanztest from Stiftung Warentest, Bund der Versicherten, Arbeitskreis Beratungsprozesse. No biased influences, compensation preferences, or subjective requirements. Best Price-Performance Ratio.

Pensions

Huge demographic transformations are affecting the retirement system in Germany. Innocently relying only on public pensions will most likely bring serious complications for both Germans and expats alike.

Why is this relevant to you?

Expats face unique challenges in their quest for good quality of life after they retire:

- Bigger voids. In old-age provision this is one issue faces, since their high income during their working life cannot be sustained once they retire.

- International Supplies. Multiple contributions in several pension systems all around the world make it hard to accurately calculate their unfulfilled provision.

- Family support. Additional needs of families in their homelands have to be considered.

- Proficiency shortage. Lack of knowledge on rights, how these schemes work and how to claim their benefits.

- Delayed Start. Expats need time to settle in Germany, thus taking care of this at a much later stage, loosing a lot in the meantime.

What can be done?

Expats can take these matters into their own hands with this experience-proven blueprint:

- Individually tailored assessment of one’s own current situation in terms of insurances, risks assessment, and asset planning.

- Step by step assistance for the clients, in case of insurance claim and damage regulation. Weekly update on the claim is guaranteed.

- Yearly new assessment of the coverage and price.

How do we provide financial advisory services?

There are 5 key value propositions to working with us as expat specialists:

- 100% Cost-free. Free of costs for the appointment, resources, and support. We innovate with a compensation model, which is NOT honorary-based.

- Fiduciary Brokers. As fiduciary brokers, we are obliged to screen the whole market in the search for solutions that have our client’s best interests at heart, and not the financial product providers.

- Scientifically Tested. Our recommendations rely upon the unique DIN 77230, the official DIN Norm, basic financial analysis for private households. Neutral, measurable, and objective. Universities, Consumer protection NGOs, and the financial industry spent 10 years developing it.

- Consumer Protection. The product selection fulfills the rigorous criteria of 3 Consumer Protection Institutions: Finanztest from Stiftung Warentest, Bund der Versicherten, Arbeitskreis Beratungsprozesse. No biased influences, compensation preferences, or subjective requirements. Best Price-Performance Ratio.

- Expats & Experts. Certified financial advisors by the IHK- German chamber of commerce in 34c Consumer Credits, 34d Insurance agents, 34f Investment Fonds specialists, and 34i Real Estate Financing advisors.

insurances

In Germany, there are two private mandatory insurances: car insurance, and housing insurance. Besides, there are many more such as liability insurance, content insurance, legal expenses insurance or income substitute insurance, which can be very useful, if not necessary, in order to protect your life standard in Germany and avoid unexpected inconveniences.

Why is this relevant to you?

Actions and events in our everyday life, such as cycling to work, driving a car, disputes with the landlord or the employer, could turn into financially threatening situations:

- Most expatriates have little knowledge and underestimate certain risks and possible expenses in form of property loss, liability toward third parties or legal costs

- The Internet offers a lot of inputs but no serious and valid consultancy. Due to the lack of individual support you may easily fall into over-insuring, under-insuring or even pay for unnecessary products.

- Most expatriates with existing contracts lack the proficiency to understand the full extension of their coverage and gaps

What can be done?

Expats can take these matters into their own hands with this experience-proven blueprint:

- Individually tailored assessment of their current own situation in terms of insurances, risks assessment, and asset planning.

- Step by step assistance for the clients in case of insurance claim and damage regulation. Guaranteed weekly update on the claim

- Yearly new assessment of the coverage and price.

Investments

Mutual Funds

The continuously declining official interest rate makes it very difficult to generate returns from banks. However, inflation has a long-term effect on losing money, therefore it is advised to put money aside. People might think that investments are for retirement, which might be partly correct. But investments are recommended more to create and build up one’s assets, e.g. real estate, capital for purchasing real estate, liquidity reserve and not to let the money lose its value in a bank account. The point is to take into consideration what your aims are with your money and when you are ready to invest.

Why is this relevant to you?

Expats face unique challenges in their quest for a comfortable quality of life when they retire:

- You have to choose to invest your money in the whole capital market for a much higher return as what you could ever get in your bank account.

- You need to understand to some extent how the stock market works.

- You need to make the right choices for the most ideal financial vehicle to support your short-, mid- and long-term goals.

- Mutual funds are, in some ways, hidden boosters of your retirement plan.

What can you do about it?

Expats can take these matters into their own hands with this experience proven blueprint:

- Individually tailored assessment of their current situation in terms of insurances, retirement systems and asset planning.

- Personalized presentation by an expert specifically on the relevant topics to the expat in how capital investments and real estate work.

- Designing, with a structured and strategic planning, a roadmap with all parameters considered.

- Implementation and continuous monitoring of the development, making changes in the investment progress if needed.

How do we provide our financial advisory services?

There are 5 key value propositions for you to want to work with us:

- It is free of charge – appointments, resources and strategic support.

- As fiduciary brokers, we screen the whole market searching for solutions and focus on our client’s best interests, not the financial product providers.

- Our recommendations rely upon the unique DIN 77230, the official DIN Norm, basic financial analysis for private households. It is beutral, measurable, scientific and objective.

- The correct choice of the financial vehicle is done by fulfilling central criteria, using the „Best in Class“ rating, amongst others.

- Certified financial advisors approved by the IHK-German chamber of commerce according to §34c Consumer Credits, §34d Insurance agents, §34f Investment Fonds specialists, and §34i Real Estate financial advisors.

How do we provide financial advisory services?

There are 5 key value propositions to working with us as expat specialists:

- 100% Cost-free. Free of costs for the appointment, resources, and support. We innovate with a compensation model, which is NOT honorary-based.

- Fiduciary Brokers. As fiduciary brokers, we are obliged to screen the whole market in the search for solutions that have our client’s best interests at heart, and not the financial product providers.

- Scientifically Tested. Our recommendations rely upon the unique DIN 77230, the official DIN Norm, basic financial analysis for private households. Neutral, measurable, and objective. Universities, Consumer protection NGOs, and the financial industry spent 10 years developing it.

- Consumer Protection. The product selection fulfills the rigorous criteria of 3 Consumer Protection Institutions: Finanztest from Stiftung Warentest, Bund der Versicherten, Arbeitskreis Beratungsprozesse. No biased influences, compensation preferences, or subjective requirements. Best Price-Performance Ratio.

- Expats & Experts. Certified financial advisors by the IHK- German chamber of commerce in 34c Consumer Credits, 34d Insurance agents, 34f Investment Fonds specialists, and 34i Real Estate Financing advisors.