A private pension plan is one of the most popular forms of pension provision in Germany because of its flexibility.

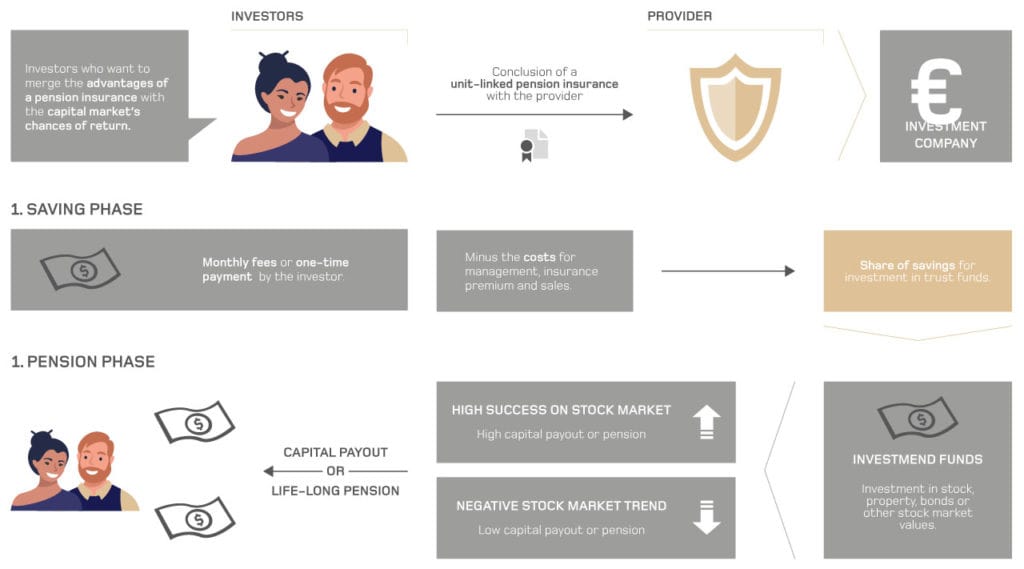

Nearly every bank and insurance company offer a flexible private pension scheme known as Private Rentenversicherung. This policy is managed for you by the bank or insurance company, yet you are full in control of the asset allocation strategy you choose.

For whom is it intended and what are the ground rules?

The Private Rente was designed for every citizen to take advantage of. It remains particularly an attractive and ideal option for expats due to its flexibility. Being able to carry on adding savings into this retirement account, irrespective of where you are living, is definitely something to consider and one less thing to worry about when moving away from Germany. Tax benefits are accomplished once the policy reaches its maturity at pension age, and from that moment on, it is up to you to build it up as a backup plan, together with the rest of your amassed pensions. Moreover, you can choose between full or part capital payment, or a lifelong pension when it reaches maturity.

Payout options and capital allocation methods

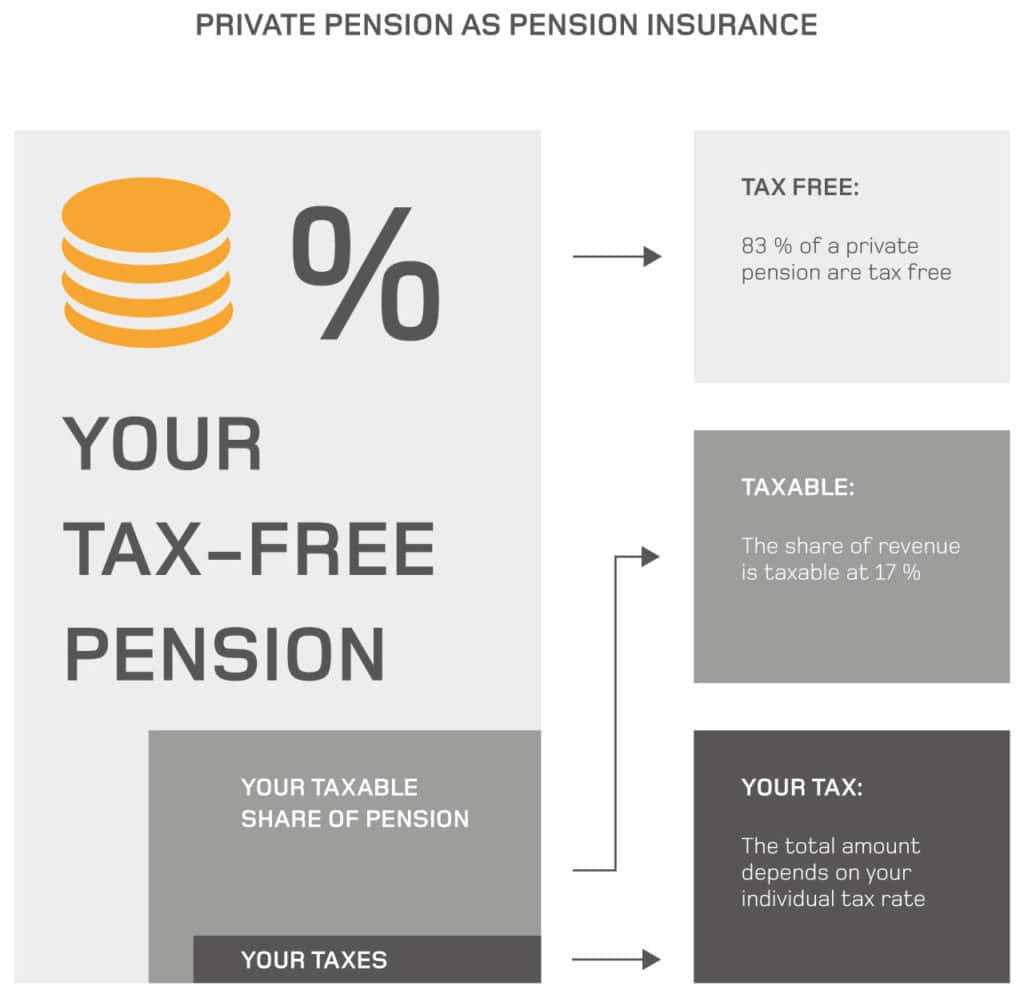

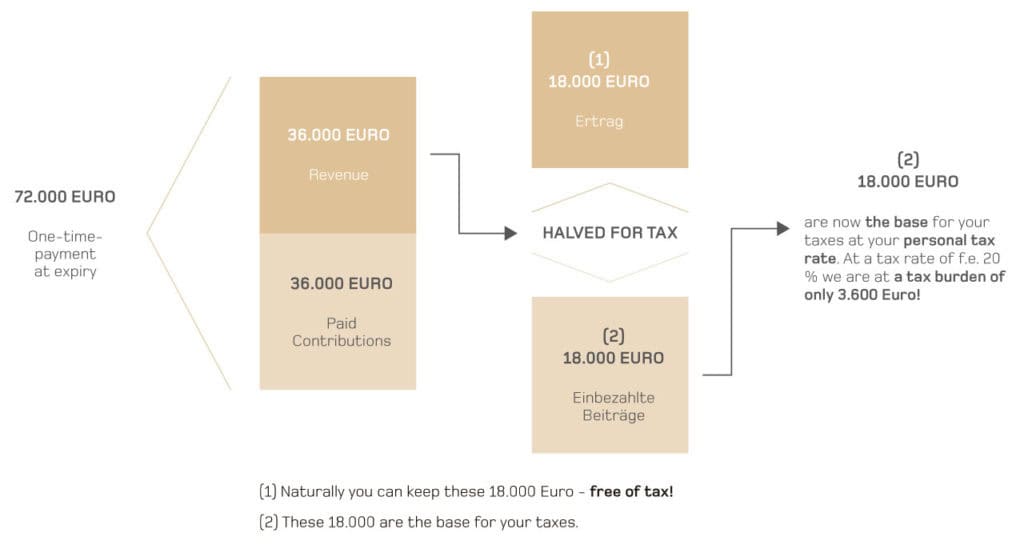

The pension draw-down can either start immediately or at a later date. Most of the products are fund-based investments. These products offer a wide range of funds to choose from; ETFs to actively managed portfolios. The advantage insurance products have is that you can switch funds, minimum of 12 times a year, free of charge and free from capital gain taxes. Should you have the feeling of being at high risk in the financial markets, some insurance companies will still offer you a classic scheme with guaranteed interest, which currently is 0.9% per year. Furthermore, because the insurers invest the money they have, they also offer performance related profit participation known as Überschusse, meaning the overall return at the moment is at least 2.25%/year (this varies slightly from company to company). There is the possible of borrowing against a Private Rente, but this can be seized and used in the calculation of unemployment benefits. At the end of the paying in phase, there is a choice between capitalization, a lifelong pension or a combination of both. If the contract runs for at least 12 years and is withdrawn at the earliest possible (at the age of 62), there are 2 different models of taxation. If capitalization is chosen, tax is paid (with a personal tax rate) on 50% of the returns. If a lifelong pension is chosen, only the Ertragsanteil gets taxed. The Ertragsanteil is a set value, depending on the age, at which the pension is withdrawn (62=21%, 63=20%, 64=19%, 65-66=18%, 67=17%). If you, for example, withdraw a pension of €1,000 at age 65 you will only be taxed (with your personal tax rate) on €180. If the above criteria are not met, the total amount will be taxed with the Abgeltungssteuer, the withholding tax. This rate is currently 25%. The pension is guaranteed for the rest of the beneficiary’s life.

Flexibility features in the Private Rente

It is possible to make part withdrawals at any time and take a loan on the current cumulated capital of your Private Rente. Normally, the withdrawal has to be a minimum of €1,000 and at least €2,500 must remain in the account.

It is possible to cancel the contract at any time and in such a case, the balance will be paid out. It is not advisable to cancel the contract during the first few years. The reason for this is because the balance would still be negatively affected by the costs. An additional occupation disability insurance can be arranged. In case of death during the paying in phase, the amassed amount is paid to the named beneficiary. In case of death during the withdrawal phase of the pension, money will be paid out to the named beneficiary for the arranged amount of time (Garantiezeit). The guaranteed payout time can vary between 5 and 18 years. It does, however, have a small effect on the amount of pension that can be withdrawn monthly. Should the policyholder leave Germany, that policy can carry on running or can be set to be contribution free. The balance will still work out for the policyholder as one’s investment in the funds continues. The capital payment or retirement pension will be received irrelevant of whether you are living in Germany or not.