Betriebliche Altersvorsorge

The BAV is an occupational pension scheme which goes hand-in-hand with employment. The BAV has numerous advantages and ways to save securely for retirement. In fact, every employee should be offered the option to create an additional pension, according to the Rentenverstärkungsgesetz.

Combining employer and governmental support in your pension

All employees working in a company have the right to a pension scheme where they can input funds themselves and not just by their employer. If you, as an expat entrepreneur, do not offer one yet, allow our experts to advise you, in-house and free of charge, on the possibilities being offered.

If you employ qualified expats into your firm, we could also offer a general live seminar or one-to-one sessions regarding education on personal finances for foreign professionals tailored to their needs.

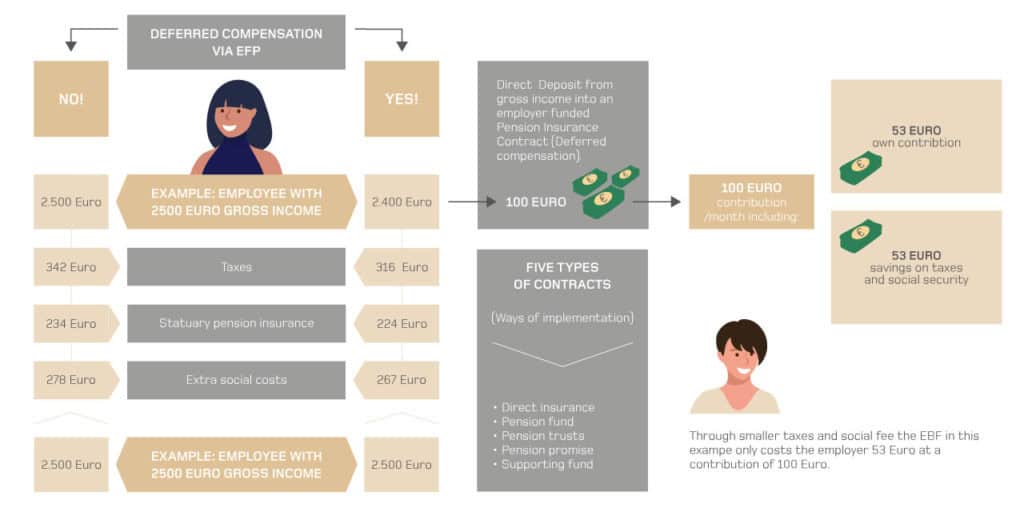

Employees could instruct their employer not to pay out part of their salary but instead to convert it into a company pension scheme known as ‘deferred compensation’. If you choose a BAV scheme, your employer would be obliged by law to convert up to 8% of your salary before paying any taxes (up to a maximum of €6,240/year) to be used as direct payments into a BAV. Alternatively, 4% may be taken from your salary before you pay taxes and social security contributions.

Who is eligible for BAV?

Company pension schemes are open for employees – more precisely, salaried employees, wage earners, trainees and (non-)controlling shareholder-managers of a GmbH, as well as members of board of directors of a corporation. Furthermore, company pension schemes can be promised to external personnel if they work solely for one company.

Designing options and flexible forms

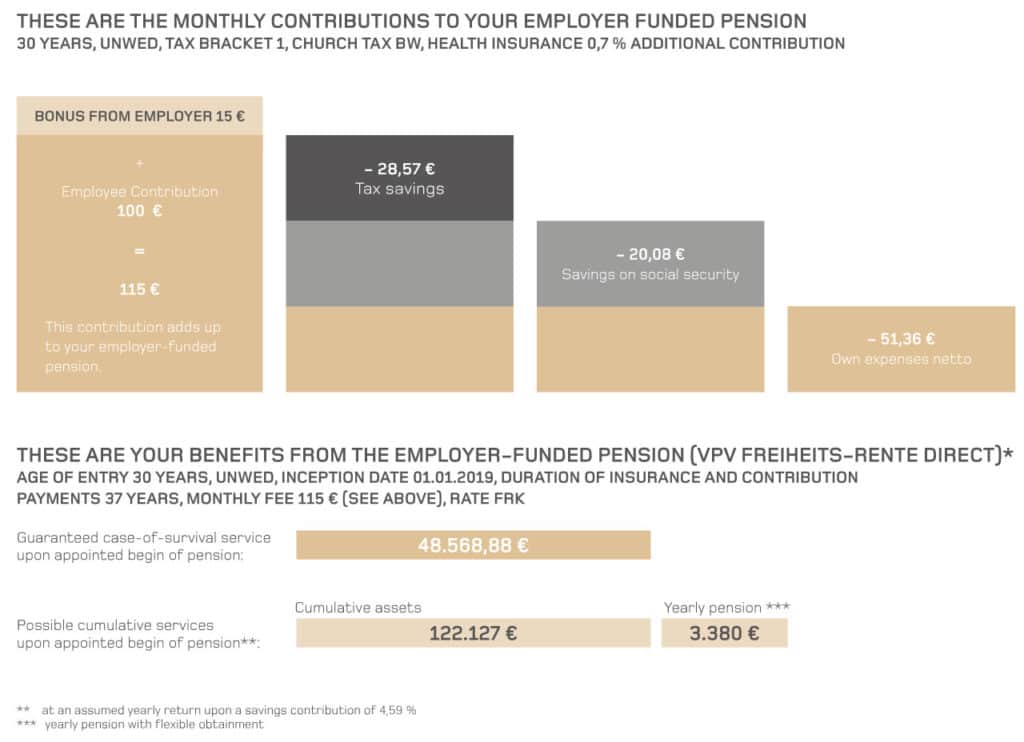

It is of course possible to take your company saving pension scheme with you, should you change your employer. Occupational pension schemes are also based on the same principles as private pension insurances. Your employer can choose the insurance provider used for the BAV scheme. As the employer, will also save the employees half of the social security contributions. The employee is obliged to pay the minimum subsidy which is 15% of the saving amount into the scheme as well. The money saved may be paid out in the form of a lifelong pension (where you will receive a certain amount every month until the end of your life, dependent on the saved capital sum), a full lump-sum pay-out (where the entire saved retirement capital is paid out at one go) or as a partial lump pay-out (where a part of the capital is paid out, often around 30%, and the rest is paid out later on as a lifelong pension).

Tax and social security will be liable when the benefits are paid out (during retirement or whenever they are received). If a contract for a BAV has been signed after the year 2012, the earliest the benefits can be claimed is at the age of 62. However, this is normally taken when you first claim your full German state pension. It is important to be aware that by reducing social security contributions, you are effectively lowering the amount that you are contributing to the German state pension. This would mean that the pension received for retirement from the DRV will be slightly lower.