Deutsche Rente

When it comes to pensions, more than 30 million employees in Germany tend to rely on the pillar of state pension. However, due to the negative demographic development in the country, the number of pensions will continue to decline in the coming years. As a result, fewer employers will be able to finance pensions. Thus, in order to secure the standard of living for later on in life, additional private pension planning is crucial to safeguard oneself from falling victim to poverty in old age.

Basic Provision with foreseeable gaps

The German pension insurance (DRV) was founded in 1891 by the German Reich Chancellor Bismarck. It states that all employees must pay into the DRV. Standard pensions begin at the age of 67, and early retirement from 65 onwards is only possible to a limited extent, but costs insured persons about a 10% deduction from their pension. Self-employed individuals may offer to be voluntary members. Independent professionals in their respective chambers, such as doctors or lawyers, can join their own pension funds known as the Versorgungswerke instead of the DRV. Public servants receive a pension from the Beamteversorgung, which is from the state, not from the DRV.

It is crucial to mention that in order to be eligible for a lifelong pension, one must have paid a percentage for this for at least five years (>60 months). If you have worked in Germany for less than 60 months, on returning to a non-European country, you can request your share of contribution back up to two years after leaving Germany. Should you require such a service, we are here to assist you with our expertise so that this could be done correctly and securely. The contribution rate is currently 18.6%, half of which is to be paid by the employee and the other half by the employer. The billing and bank transfers are automatically carried out by the employer. No account – no interest rate – no capital formation. The DRV works by a ‘pay-as-you-go’ system known as Umlageverfahren. Also known as an intergenerational contract, working-generation pension contributions are directly used to finance the current pensions of the elderly; first in – first out. The DRV supposedly mentions a “pension account”, but in actual fact, this account does not contain any capital that is personally allocated to the insured person. Through FIFO, it is also not possible to create any capital that could bear interest.

Demographic problems and the pension level

The DRV ‘pay-as-you-go’ system is economically dependent on the number of contributors and their income. In the past 30 years, pensions in Germany had to be constantly cut, mainly due to the mass unemployment and the corresponding lack of premium payments. Furthermore, demographic problems continue to rise until the last baby boomers retire from around 2025 onwards. For the last 50 years, birth rates have been declining. Every retired couple has on average only 1.4 children who would have to bear the pension burden for both their parents. The DRV opts for a mixed approach in such a situation: contributions will rise and pensions will fall. As a result of these reforms, the net pension level (supply ratio) has decreased, which is the comparison of net pensions to the last working income before retirement.

Basis Rente

As certified advisors specializing in expats, we offer our unique service in advising our clients of the three main allies in their quest for a favorable retirement: the compound interest effect, the German State and us.

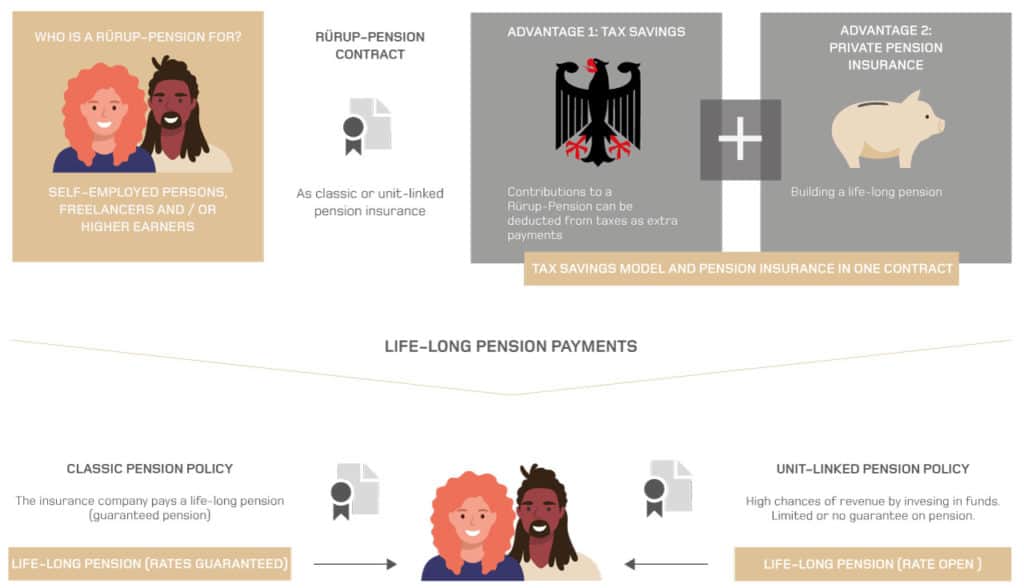

For whom is this targeted?

The Basis Rente was introduced in 2005 for the self-employed and high-income earners to benefit from. You can pay up to €25,787/year into the scheme if you are single or up to €51,574 if you are married. The premiums can be from 2025 on 100% deductible from taxes. You have the option of paying low monthly premiums and towards the end of the year, after having an overview of your total income, you could pay a larger sum to avoid paying taxes. It pays out as a lifelong pension and the earliest that the pension can be withdrawn is from the age of 63.

Maximum thresholds and government support

In 2004, the average pensioner received about 50% of his final income as a pension. By 2030, this figure is expected to fall to around 43%. One main reason for this is a major tax reform (age-related income act), in which two tax steps were introduced. Since 2005, 60% of pension contributions can be deducted from tax at an increasing annual rate (100% as of 2025). Pension payments, moreover, are being taxed at an increasing rate (100% from 2040 onwards). To give an example, a pensioner who retired in 2005 has to taxed 50% for his lifelong pension, whereas an employee’s contributions into the DRV are 100% tax-free in 2025.

Rürup Rente was the name given after its founder. Contributions made to the state pension scheme and to Basis Rente can be offset to a maximum total of €25,787 a year for singles and €51,574 a year for couple (married or registered partnerships). For instance, a single person with a salary of €85,200 in 2021 pays (including employer contributions) a maximum amount of €14,954 into the German state pension system, meaning he still has an amount of €9,350 per year (or €779 a month), which he can profitably save for his retirement with his Basis Rente. From his savings, that person can comfortably claim up to 45% return yearly from his tax declaration.

Taxation of savings and pensions

In 2021, 92% of the contributions can be offset against taxation. This value will rise by 2% every year until the year 2025, increasing up to 100%. The value will rise automatically, regardless of when the policy was introduced.

It is possible to give small monthly contributions throughout the year and pay a generous amount at the end of the year in order to take full advantage of the tax benefits. The monthly pension received is taxed on the pensioners personal tax rate. As a pensioner in Germany, tax regulations differ from the tax during time of employment.

Multiple allocation methods for your savings

The majority of Basis Rente products are fund-based investments. The products themselves offer a wide range of funds to choose from, including actively managed portfolios. The advantage of the insurance-based products is that they offer the flexibility to switch funds, at least 12 times a year, free of charge without having to pay any capital gains tax as in a normal ETF saving plan.

Useful features for worst case scenarios

Capital cannot be borrowed against a Basis Rente, nor can there can be a seizure its value. It is protected against unemployment and insolvency. Pension is guaranteed for the rest of the policyholders’ life. A pension can be first withdrawn at the age of 62 via a bank account in Germany. In case of death during the paying-in phase, the amassed amount will be converted and paid to the legal beneficiary (i.e. a partner, heirs). The guaranteed payout time can vary from 5 to 18 years. The amount of pension that can be withdrawn monthly would of course be slightly affected.

Should the policyholder decide to leave Germany, the Basis Rente policy can be set to non-contributory. The balance will still be sufficient for the policyholder, as the investment in funds continues. In that case, the pension will be paid out in the policyholders’ new country of residence.